Artificial Intelligence

Samsung cracks the Nvidia nod

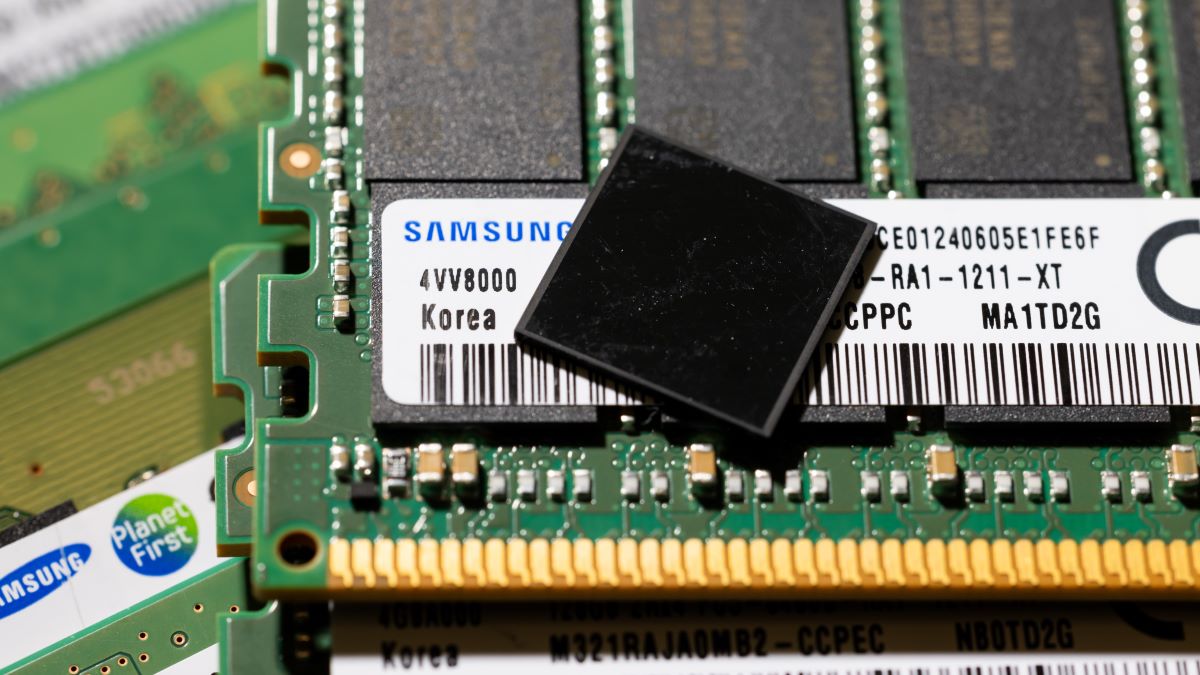

Samsung, after a series of setbacks in developing the type of memory chips crucial for the AI market, is beginning to make progress in narrowing the gap with rival SK Hynix

Samsung is making strides in narrowing the gap with rival SK Hynix in the development of memory chips critical for the artificial intelligence market. The company has achieved significant progress, securing approval from Nvidia for its high-bandwidth memory chips, called HBM3. Samsung anticipates approval for the next generation, HBM3E, within the next two to four months.

In the past, Samsung faced challenges in the HBM sector, allowing SK Hynix to take the lead. Samsung, historically a leader in the memory chip market, made the unusual move of replacing the head of its semiconductor division in May to address these setbacks.

While Samsung has not disclosed specific partners, the company stated it is collaborating closely with customers, and testing is progressing smoothly. These advancements position Samsung well to capitalize on the increasing demand for AI products. The HBM market is projected to grow significantly, reaching $71 billion in 2027, creating opportunities for Samsung to generate more revenue.

Analysts believe that Samsung’s recent accomplishments could lead to a change in investors’ perception of the company. They forecast that Samsung could secure additional market share in the HBM sector, potentially adding $4 billion in revenue by 2025. Despite trailing behind SK Hynix currently, this progress could positively impact Samsung’s stock performance.

When Samsung reports its final second-quarter earnings, questions regarding its HBM strategy may arise. While Samsung is on track to secure Nvidia’s approval by November, there are still challenges to overcome, with potential delays expected until 2025 due to the complexity of AI chips.

Executives at Samsung have implemented measures to address engineering challenges and enhance innovation within the company. Samsung has modified its HBM design to improve heat management and power consumption, leading to the approval of HBM3 for Nvidia.

Samsung’s financial strength and production capacity provide a competitive advantage. Once it meets Nvidia’s criteria for approval, Samsung can swiftly increase production to address supply shortages in the market.

SK Hynix remains a formidable competitor, with plans to accelerate the production of HBM3E products and introduce next-generation chips. Under new leadership, Samsung continues to make progress, developing its own 12-layer HBM3E technology and seeking approval for future chip generations from Nvidia.

The market’s potential revenue growth, estimated at $71 billion by 2027, presents opportunities for Samsung to establish itself as a strong second source to Nvidia and bolster its position in the memory chip market.