411

When Should You Start Investing for Long-Term Wealth?

Investing is one of the most powerful ways to build wealth, but many people hesitate to dive in. Whether you’re in your twenties or fifties, the question is: when is the best time to start investing? The answer isn’t the same for everyone, but there are key factors to consider, including your age, financial stability, goals, and risk tolerance. In this article, we’ll break down when to start, when it’s potentially too late, and give you actionable tips to help you begin your investment journey.

1. Start Investing in Your 20s: The Power of Time

If you’re in your 20s, congratulations! You have a huge advantage over others — time. Starting to invest at this age allows you to take full advantage of compound interest, meaning your money grows exponentially the longer it has to work for you. Even if you can only afford to invest a small amount initially, starting early sets you on a path to significant wealth down the line.

Why It’s Important to Start Now:

-

Compounding Returns: The earlier you start, the more time your investments have to grow. Small contributions can grow into large sums over the decades.

-

Lower Risk Tolerance: At this stage, you can afford to take on more risk because you have time to recover from any market downturns.

-

Building Habits: Investing early helps you form the financial discipline needed to stay on track for your goals.

Tip: Even small, regular investments in index funds or retirement accounts can pay off in a big way over time.

2. In Your 30s: It’s Time to Build Momentum

By the time you’re in your 30s, you should have a better understanding of your finances, and it’s likely that you’ve started to build some savings. This is a great time to start investing, especially if you haven’t already. At this stage, your earning potential is generally higher, and you can take more calculated risks.

Why Start Now:

-

Maximize Retirement Savings: You still have time to grow your retirement savings before you need them, but the earlier you start, the better your position will be.

-

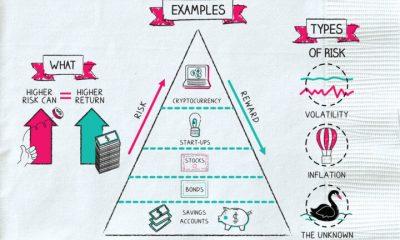

Diversify Your Portfolio: In your 30s, it’s time to diversify your investments, from stocks and bonds to real estate and retirement accounts.

-

Achieve Financial Goals: Whether you’re saving for a home or your children’s education, investing helps you achieve these milestones faster.

Tip: Set aside money for both long-term (retirement) and short-term (house down payment) goals. Consider a mix of investments, such as stocks for growth and bonds for stability.

3. 40s and 50s: Playing Catch-Up and Minimizing Risk

In your 40s and 50s, you may find that time is running out to meet certain financial goals, like retiring comfortably. If you haven’t already started investing, now is the time to get serious. While you don’t have as much time for investments to grow, you can still make significant progress if you act strategically.

Why It’s Not Too Late:

-

Maximized Earnings: At this stage, you are likely earning more than when you were younger, which gives you more money to invest.

-

Less Risk, More Focused Strategy: As you near retirement, you may want to shift your investments to safer, income-generating options, like bonds or dividend stocks, to preserve your capital.

Tip: Focus on maximizing your retirement contributions and shift to a more conservative portfolio to ensure you’re financially secure for the long haul.

4. When is It Too Late to Start Investing?

While there’s no age that’s too late to start investing, the later you begin, the less time your investments have to grow. If you’re over 60 and haven’t invested, the amount of risk you can take decreases significantly. In such cases, it becomes important to focus on safe, stable investments and prioritize income-generating assets.

However, even at 60+, it’s not impossible to make your money work for you — you just need to be strategic. If you’re nearing retirement, focus on securing your retirement nest egg rather than high-growth opportunities.

Tip: At this stage, consider working with a financial advisor to create a strategy that fits your retirement goals and reduces risk.

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com