411

VAT Increase in 2025 Budget: How South African Households and Businesses Will Be Affected

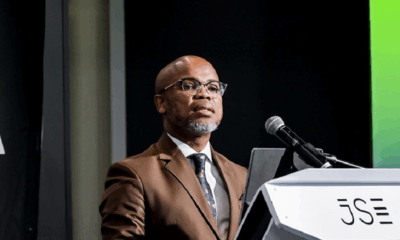

The 2025 Budget Speech, delivered by Finance Minister Enoch Godongwana, has introduced significant fiscal measures aimed at addressing South Africa’s economic challenges. Among the most debated changes is the proposed increase in value-added tax (VAT), which will have far-reaching implications for both households and businesses. Here’s what you need to know about the VAT hike and its broader impact.

The VAT Increase: A Gradual Rise to 16%

The government has announced a gradual increase in the VAT rate, with a 0.5% rise in 2025/26, followed by another 0.5% in 2026/27. This will bring the final VAT rate to 16%, up from the current 15%. The increase is expected to generate an additional R28 billion in revenue for the upcoming fiscal year and R14.5 billion in the subsequent year.

While VAT is considered one of the more efficient forms of taxation, its regressive nature means that lower-income households will bear a proportionally higher burden. To mitigate this impact, the government has expanded the list of VAT zero-rated food items, including canned vegetables, dairy liquid blends, and certain organ meats. However, the increase will still place additional pressure on household budgets, particularly for those already struggling with rising living costs.

Impact on Businesses

For businesses, the VAT increase will require operational adjustments to accommodate the new tax rate. Companies will need to update their accounting systems, revise pricing strategies, and ensure compliance with the updated regulations. Failure to do so could result in penalties from the South African Revenue Service (Sars), which has been allocated R3.5 billion in the current financial year and an additional R4 billion over the medium term to enhance tax collection and enforcement.

The government’s focus on compliance is clear, with Sars identifying 156,000 unregistered taxpayers despite their substantial economic activity. Businesses must prioritise accurate financial reporting and robust accounting systems to avoid falling foul of the tax authorities.

The Role of Technology in Compliance and Efficiency

A key takeaway from the 2025 Budget is the increasing role of technology in improving tax compliance and revenue collection. Sars has been making strides in digital transformation, leveraging data analytics and automation to identify non-compliance and streamline tax administration. This presents an opportunity for businesses to future-proof their operations by investing in digital financial management solutions.

Cloud-based accounting and VAT management tools can simplify tax calculations, automate reporting, and reduce errors. With real-time data access and AI-driven insights, businesses can enhance their financial planning and compliance, ensuring they remain aligned with Sars’ digital initiatives.

Effectiveness Under the Government of National Unity (GNU)

The implementation of these fiscal measures occurs under the newly established Government of National Unity (GNU), a coalition-driven governance model that brings together diverse political stakeholders. While the GNU presents an opportunity for more inclusive decision-making, its effectiveness in executing economic policies remains to be tested.

The VAT hike and tax adjustments reflect the government’s attempt to balance fiscal sustainability with social priorities. However, challenges may arise in policy consistency, bureaucratic efficiency, and stakeholder alignment within the GNU framework. Businesses must remain agile, as shifting political dynamics could influence regulatory enforcement and economic strategies.

Preparing for the Future

As South Africa navigates its fiscal challenges, businesses must remain proactive in their approach to tax planning and compliance. The VAT increase, coupled with enhanced enforcement by Sars, emphasises the need for accurate financial reporting and robust accounting systems. Embracing technology-driven solutions will be key to staying ahead in an evolving regulatory environment.

The VAT increase in the 2025 Budget is a significant development that will impact both households and businesses across South Africa. While the government has taken steps to mitigate the impact on lower-income households, the regressive nature of VAT means that many will still feel the pinch. For businesses, the increase underscores the importance of compliance and the need to invest in technology to streamline tax administration and financial management. As the GNU works to implement these changes, businesses and individuals alike must stay informed and prepared to adapt to the evolving fiscal landscape.

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com