411

Big VAT Changes for South Africa Expected in 2025 Budget

South Africa could see major VAT policy changes next week when Finance Minister Enoch Godongwana delivers the 2025 National Budget Speech on February 19, 2025.

While an increase in the VAT rate from 15% is unlikely due to the already high tax burden on consumers and businesses, Deloitte tax experts believe the government may expand the zero-rated goods list to provide relief to struggling households.

Will VAT Increase in 2025?

Many analysts argue that increasing VAT would be the easiest way to raise revenue, but it would disproportionately affect low-income South Africans.

Instead of raising VAT, the National Treasury is expected to focus on improving SARS’s revenue collection through new technologies and better compliance measures.

Which Products Could Be Added to the Zero-Rated List?

Zero-rated goods are exempt from VAT, reducing costs for consumers. South Africa currently has 19 basic food items on the list, including:

Brown bread, maize meal, samp, dried beans, lentils, pilchards in tins

]Milk powder, rice, vegetables, fruit, vegetable oil, eggs

Experts predict that new items may be added, though the exact choices remain uncertain. Some possible additions include:

- Canned foods (such as tinned meats or additional fish varieties)

- Chicken (a staple protein source for many households)

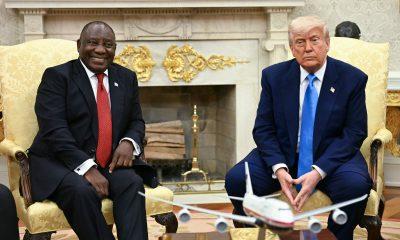

While President Cyril Ramaphosa has previously supported expanding VAT exemptions, Deputy Finance Minister David Masondo has warned that increasing the zero-rated list would reduce VAT revenues, impacting government funding for pro-poor programs.

Could Smartphones Become VAT-Exempt?

An unexpected tax break for smartphones is also under discussion.

With South Africa phasing out 2G and 3G devices by 2027, lower-income households could struggle to afford 4G-compatible phones, which start at around R800—a significant jump from R150 for basic 2G phones.

Deloitte experts argue that zero-rating certain smartphones could:

Make digital communication more accessible, especially in rural areas

Support SARS’s digital tax collection efforts

Help bridge the digital divide in South Africa

With South Africa’s economy under pressure, the 2025 Budget Speech is expected to focus on balancing revenue collection with economic relief. Expanding the zero-rated VAT list—potentially to chicken, canned goods, and even smartphones—could provide much-needed support for struggling consumers.

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com