411

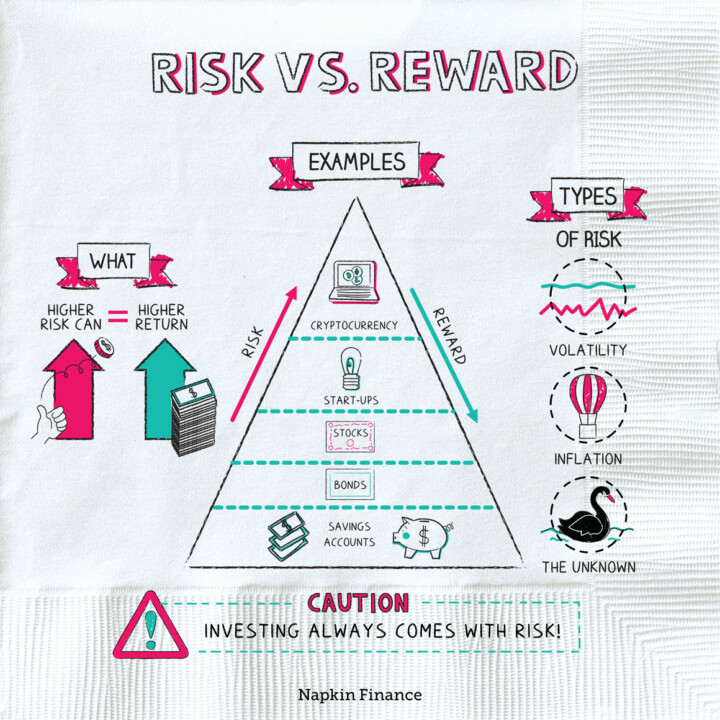

What are the 5 Risks vs. 5 Rewards of Investing

Investing is often hailed as a way to build wealth, but it comes with both risks and rewards. Understanding these factors is essential for making informed investment decisions. Here’s a breakdown of the five key risks and five rewards associated with investing.

5 Risks When Investing

-

Market Volatility The financial markets are inherently volatile, meaning that the value of your investments can fluctuate significantly in short periods. This volatility can be unsettling for investors, especially those with short-term investment horizons.

-

Risk: Market downturns, such as recessions or economic slowdowns, can cause a sudden decrease in the value of stocks, bonds, or other assets.

-

Tip: Long-term investors can often ride out short-term fluctuations, but those looking for short-term gains may be at risk during volatile periods.

-

-

Loss of Capital One of the primary risks in investing is the potential loss of the original amount of money you invested. Certain investments, like stocks or high-risk assets, can lose their value and result in a complete or partial loss of your capital.

-

Risk: If a company goes bankrupt or an investment turns sour, you may lose some or all of your invested funds.

-

Tip: Diversification can help reduce this risk by spreading investments across various asset classes and industries.

-

-

Inflation Risk Inflation erodes the purchasing power of money over time. If your investments are not growing at a rate that outpaces inflation, the real value of your returns could diminish.

-

Risk: For instance, if inflation rises by 5% annually, but your investments only grow by 3%, the real value of your returns is negative.

-

Tip: Consider investing in assets like stocks or real estate, which have historically outpaced inflation over the long term.

-

-

Interest Rate Risk Interest rate changes can have a significant impact on investment values, particularly in bond markets. When interest rates rise, bond prices typically fall, which can affect the value of fixed-income investments.

-

Risk: If you invest in bonds and interest rates increase, the market value of your bonds may decrease, leading to potential losses.

-

Tip: Pay attention to the interest rate environment and adjust your investment strategy accordingly, such as holding bonds to maturity.

-

-

Liquidity Risk Some investments, like real estate or private equity, are not easily convertible to cash, which can create problems if you need access to your funds quickly. If you cannot sell an asset at the right time or for the right price, you may face significant losses.

-

Risk: The inability to quickly sell an investment or asset could prevent you from taking advantage of market opportunities or meeting urgent financial needs.

-

Tip: Ensure a portion of your portfolio is invested in liquid assets, such as stocks or bonds, to maintain flexibility.

-

5 Rewards When Investing

-

Wealth Accumulation One of the most significant rewards of investing is the potential for wealth accumulation over time. By consistently investing in assets that appreciate, you can grow your wealth and secure your financial future.

-

Reward: Stocks, real estate, and other investments can appreciate significantly over the long term, giving you the chance to increase your wealth.

-

Tip: Starting early and staying consistent with your investment strategy will maximize the potential for wealth accumulation.

-

-

Compounding Returns Investing allows you to take advantage of compound interest, where the earnings on your investment (interest, dividends, or capital gains) generate additional earnings over time. This “snowball” effect can significantly boost your investment returns.

-

Reward: Compound interest makes your money work for you, allowing it to grow exponentially over the long term.

-

Tip: The earlier you start investing, the more time your money has to compound, leading to potentially higher returns.

-

-

Income Generation Certain investments, such as dividend-paying stocks, bonds, or rental properties, provide regular income streams. This can offer financial security and help supplement other sources of income.

-

Reward: Consistent income from investments can create passive income streams, helping to cover living expenses or reinvest for further growth.

-

Tip: Look for income-generating investments if you want a more predictable return, especially during retirement.

-

-

Tax Benefits Many investment options offer tax advantages, such as tax-deferred growth or tax-free withdrawals. Retirement accounts like IRAs and 401(k)s, for example, allow your investments to grow without immediate taxation.

-

Reward: Tax advantages can enhance the overall returns of your investments, allowing more of your earnings to be reinvested.

-

Tip: Take advantage of tax-efficient investment vehicles, like retirement accounts, to reduce your tax burden and maximize growth.

-

-

Hedge Against Inflation Certain investments, particularly real estate, stocks, and commodities like gold, have historically been effective at keeping pace with or outpacing inflation. These assets help protect your purchasing power over time.

-

Reward: Investing in inflation-protected assets ensures that your investment’s value grows in line with or ahead of inflation, preserving your wealth.

-

Tip: Include a mix of inflation-hedging investments in your portfolio to protect against rising costs over time.

-

Investing offers both significant risks and rewards, and understanding these factors is essential for making informed decisions. While market volatility, loss of capital, and inflation can pose challenges, the potential for wealth accumulation, compounding returns, and income generation makes investing a worthwhile pursuit for many. By balancing risks with rewards and aligning your investments with your financial goals, you can navigate the complexities of investing successfully.

What strategies do you use to balance risk and reward in your investments?

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com

Picture: Napkin Finance