411

South Africa’s Cashless Society: Balancing Convenience with Consumer Caution

As South Africa steadily advances towards a cashless society, the promise of efficiency and convenience comes hand-in-hand with real-world concerns that can’t be ignored. While digital payment methods like PayShap and mobile wallets are gaining traction, cash remains deeply woven into the daily lives and financial habits of millions.

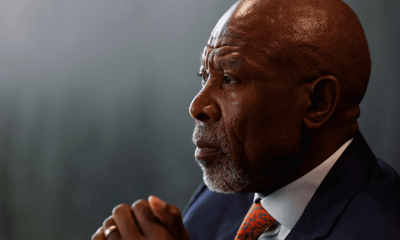

According to Nthabiseng Mohale, Manager of Interbank and Regulatory Forums at Standard Bank Corporate and Investment Banking, “Cash remains an integral part of South Africa’s economy.” Stats SA backs this up — with R171 billion still in circulation in 2023, cash usage hasn’t shown a significant decline since 2009.

Why Cash Still Matters

For many South Africans, especially those in informal sectors or rural areas, cash is more than just currency — it’s control, familiarity, and a buffer against unexpected financial pitfalls.

“There’s a deeply rooted trust in physical money,” said Mohale. “People fear unauthorised debit orders, hidden fees, and bounced payments — all legacies of past financial abuses that have made consumers cautious about going fully digital.”

Digital Payments on the Rise

Despite this hesitation, digital options offer compelling benefits. Solutions like PayShap, mobile wallets, and wearables provide speed, cost savings, and accessibility — especially useful for small businesses and spaza shop owners.

If payments are made instantly via mobile or digital wallets, these businesses can restock their inventories faster through online ordering, boosting their working capital and overall efficiency. In the long run, this could also help informal businesses build a credit history and access broader financial services.

The Path Forward: Trust and Transparency

To make the cashless transition truly inclusive, stakeholders in the financial ecosystem — from banks to regulators — need to address public concerns head-on.

“There must be stronger consumer protection, clearer regulations, and better communication between banks and customers,” said Mohale. Only then will more South Africans begin to see the real value in digital payments and gradually move away from their dependence on cash.

A Shift Worth Making — With Care

The momentum is there, and the technology is ready. But South Africa’s move toward a cashless society must be done thoughtfully, respecting the economic realities and financial anxieties of its people. With the right balance of innovation, education, and regulation, the future of payments in South Africa could be fast, secure, and truly inclusive.

{Source George Herald}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com