Business

How Two of South Africa’s Richest Men Made Billions Amid Trump’s Tariff Turmoil

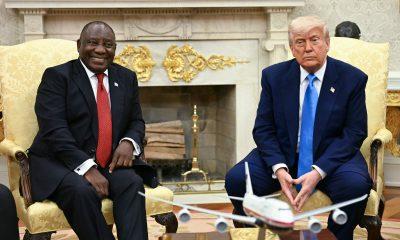

While global markets have stumbled under the weight of Donald Trump’s aggressive tariff policies, two of South Africa’s richest businessmen have seen their fortunes soar by billions.

Despite widespread losses across major indices like the S&P500 and Nasdaq, luxury goods tycoon Johan Rupert and wholesale magnate Natie Kirsh have bucked the trend in remarkable fashion.

Both men appear on the Bloomberg Billionaires Index, at positions 142 and 296, respectively. Their wealth has not only weathered the storm but grown faster than many global benchmarks.

Riding the Storm: Rupert’s Billion-Rand Gain

Johan Rupert, chair of the Swiss-based luxury empire Richemont, has seen his net worth rise to $15.5 billion (roughly R287.5 billion). Since January, Rupert has added an impressive $1.84 billion to his fortune — that’s about R34 billion in local currency.

Richemont owns some of the world’s best-known luxury brands, including Cartier and Montblanc. While markets dipped following Trump’s tariff bombshell in early April — dubbed “Liberation Day” by the former U.S. president — Rupert’s holdings surged ahead of the downturn.

Natie Kirsh’s Comeback Story

At 93 years old, Natie Kirsh continues to defy economic headwinds. Kirsh has reversed earlier losses to post a 6.8% rise in wealth this year, bringing his net worth to $9.97 billion (around R185 billion).

Kirsh built his empire largely through Jetro Holdings, a New York-based operator of Restaurant Depot and Jetro Cash & Carry, which supplies bulk goods to independent food service businesses across the U.S.

Even as U.S. markets fell sharply — the Nasdaq dropped nearly 10% year-to-date, and the S&P500 slipped 5.79% — Kirsh’s investment model held strong.

Trump’s Tariff Moves Shake Markets, But Not All Investors

Trump’s declaration of April 2 as “Liberation Day” saw the U.S. slap import tariffs as high as 245% on Chinese goods. While he later backtracked and reduced global duties to 10% for 90 days, China remained the primary target with taxes of up to 145%.

Markets reacted swiftly and negatively. Billions were wiped from tech stocks and industrial giants alike. But for Rupert and Kirsh, their exposure to sectors less dependent on U.S.-China dynamics — such as luxury goods and wholesale retail — helped insulate them.

Context: Wealth in a South African Perspective

To grasp the magnitude of their gains, consider this: South Africa’s total GDP last year was R7.5 trillion. Rupert and Kirsh now jointly hold wealth worth nearly R473 billion, making them economic forces in their own right.

As the global financial system recalibrates under new trade policies and political volatility, their continued success serves as a reminder: in uncertainty lies opportunity — especially for those positioned well.

{Source: IOL}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com