Business

South Africa Faces Uncertainty Over Interest Rate Cuts in 2025

South Africans hoping for significant interest rate relief in 2025 may need to temper their expectations. Traders have scaled back their predictions, now anticipating just a single 25-basis-point cut this year. This cautious outlook reflects evolving global financial conditions, including the Federal Reserve’s slower pace on rate adjustments and the potential impact of US President-elect Donald Trump’s tariff policies.

Markets Adjust Expectations

Forward-rate agreements, which are used to speculate on borrowing costs, indicate that the South African Reserve Bank (SARB) might cut interest rates only once this year. The central bank’s Monetary Policy Committee (MPC) meeting on 30 January will be closely watched for further signals.

Marek Drimal, a strategist at Societe Generale, suggests that SARB may even postpone the anticipated cut until March due to external pressures and less favorable financial conditions.

This cautious market stance contrasts with the views of many economists, who expect SARB to reduce rates by 50 basis points in the first quarter and implement a further 25 basis point cut later in the year.

Caution Amid Economic Uncertainty

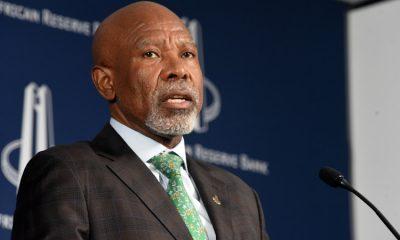

Reserve Bank Governor Lesetja Kganyago has emphasized a cautious approach, warning against making decisions that could later be regretted.

“We should not be creating uncertainty by making moves that we would later regret,” Kganyago said in a recent interview.

The weaker rand, which has depreciated 4.5% against the US dollar since the MPC’s last meeting in November, is adding to the uncertainty. The currency’s decline has already pushed gasoline prices higher, potentially impacting SARB’s inflation forecast of 4% for 2025.

Impact of External Factors

The Federal Reserve’s slower approach to interest rate cuts and Trump’s tariff threats are influencing global financial markets, including South Africa’s. These factors could delay SARB’s plans to ease monetary policy further.

SARB prefers to anchor inflation expectations at the 4.5% midpoint of its target range. However, the recent weakening of the rand poses a challenge to maintaining this target, especially with rising fuel costs.

What Lies Ahead?

The MPC’s January meeting will provide crucial insights into SARB’s next moves. If the central bank delays cutting rates, it could signal prolonged caution amidst global and domestic uncertainties.

For South Africans, this means that relief from high borrowing costs may take longer than expected, underscoring the importance of preparing for a potentially slower rate-easing cycle.

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com