Business

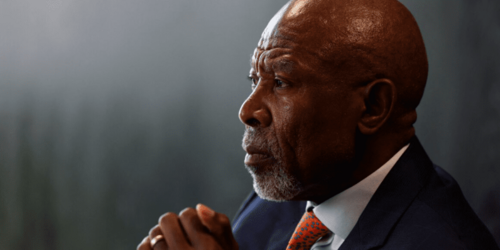

Lower Oil Prices Push South Africa’s Inflation to 4-Year Low, Says Kganyago

South Africans may have a rare reason to smile amid global economic uncertainty. According to South African Reserve Bank (SARB) Governor Lesetja Kganyago, inflation in the country has cooled to its lowest level since the early months of the pandemic—thanks largely to a drop in international oil prices.

Speaking to Bloomberg TV on the sidelines of the International Monetary Fund (IMF) and World Bank Spring Meetings in Washington, Kganyago said the inflation outlook has improved despite recent currency depreciation.

“We still think that the next print might still have a 2-handle to it, but the environment is uncertain,” Kganyago explained.

He emphasized that while the South African rand has weakened, the sharp decline in oil prices has had a stronger, more positive influence—pulling inflation down to 2.7% in March, compared to 3.2% in February. That marks the lowest inflation reading since June 2020.

A Delicate Balance for SARB

In March, the SARB’s Monetary Policy Committee (MPC) chose to hold interest rates steady at 7.5% after three consecutive cuts of 25 basis points each. The committee cited mixed signals from the global economy and a “neutral” policy stance.

Economists remain divided over whether the MPC will cut rates again or maintain the current pause when it meets on May 29. Much will depend on inflation trends, the strength of the rand, and global economic developments.

“The confidence about global economic developments that we had in October has since eroded,” Kganyago warned. “That heightened uncertainty means rates will likely stay higher for longer.”

IMF Downgrades Growth Forecast

Meanwhile, the International Monetary Fund this week revised South Africa’s growth forecast for 2025 downward—from 1.5% to 1%. The IMF cited increased geopolitical uncertainty, escalating global protectionism, and slowing demand in major economies as key reasons behind the downgrade.

The SARB has also adjusted its expectations. The bank now sees inflation averaging 3.6% in 2025, down from a previous forecast of 3.9%, while economic growth is projected at 1.7%, slightly below the earlier estimate of 1.8%.

What This Means for Consumers and Businesses

For households and businesses alike, the drop in inflation is a welcome development. Lower price pressures can ease cost-of-living burdens, improve purchasing power, and reduce borrowing costs if interest rates eventually follow suit.

But with global tensions and currency instability still looming, Kganyago and his colleagues will need to tread carefully. The coming weeks—and particularly the May 29 rate announcement—will be critical for understanding where South Africa’s economy is headed next.

{Source: BusinessTech}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com