Business

Nedbank Warns South Africans About Rising Police Impersonation Scams

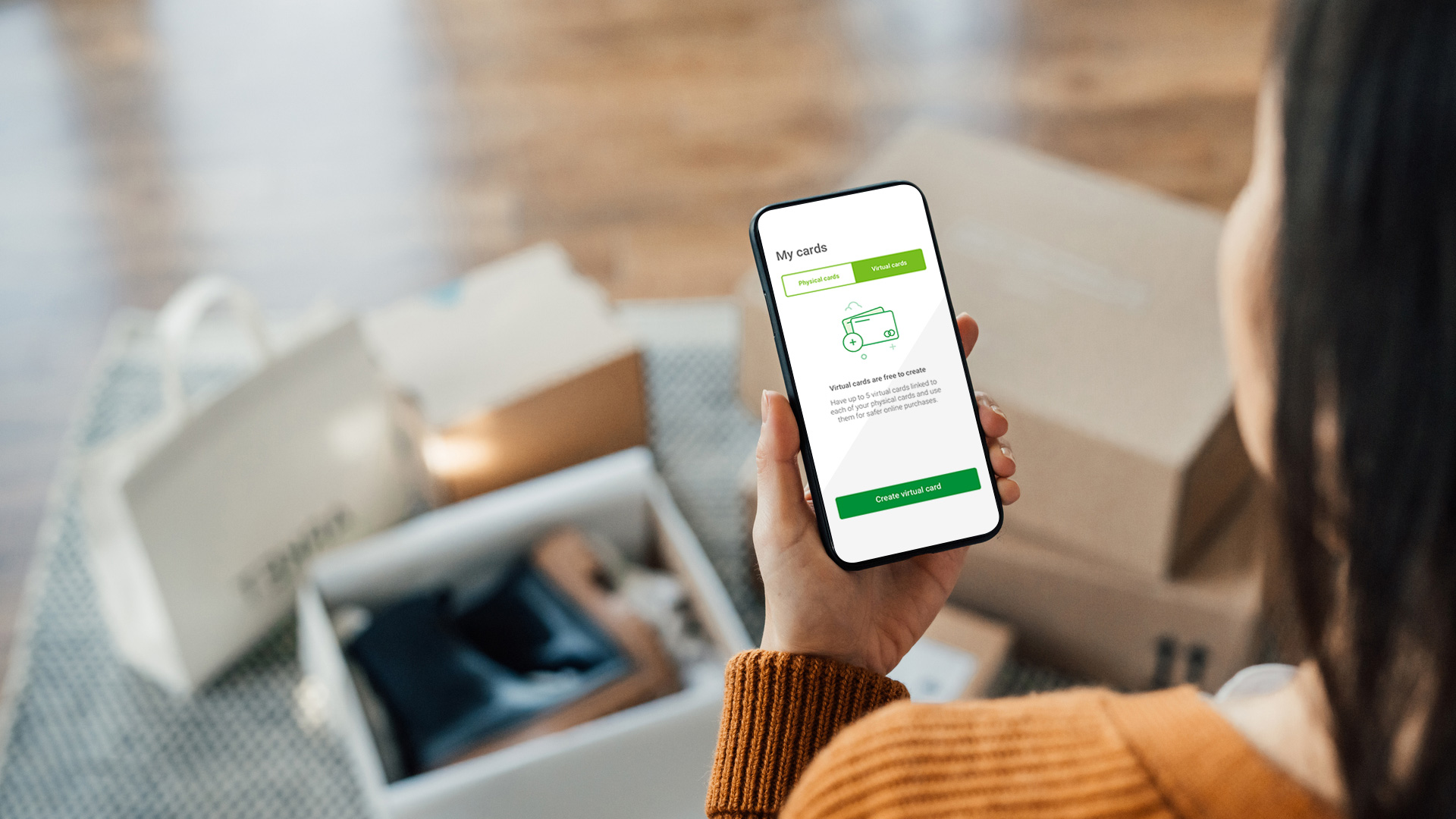

Nedbank has joined other major financial institutions in sounding the alarm over a disturbing new trend: fraudsters pretending to be police officers to scam unsuspecting customers.

In a recent fraud alert, the bank warned that criminals are using vishing (voice phishing) calls to deceive people into handing over sensitive banking details or transferring money. These scammers often pose as Nedbank fraud department employees or law enforcement officials, using high-pressure tactics to exploit their victims.

How the Scam Works

Fraudsters contact victims, claiming to be investigating fraudulent activity linked to their accounts. They then manipulate victims into:

- Downloading malicious apps from unverified links

- Moving money to a “safe” account (controlled by the criminals)

- Sharing personal information like Nedbank ID credentials, card PINs, or CVV numbers

Nedbank has urged customers to never:

Transfer money based on unsolicited calls, even if the caller claims to be from the bank.

Download apps from WhatsApp, email, or SMS links—only use official app stores.

Share banking details, passwords, or PINs with anyone.

Panic over “urgent” messages threatening account closures or legal action.

A Growing Threat in South Africa

Nedbank isn’t the only bank raising concerns. Discovery Bank recently warned customers about nearly identical scams, where fraudsters pose as police detectives, pressuring victims to transfer funds for a “fake investigation.”

Similarly, Standard Bank and Capitec have flagged other impersonation scams, including fake WhatsApp investment groups and authorised push payment fraud—where victims are tricked into sending money directly to criminals.

How to Protect Yourself

- Verify unexpected calls – If someone claims to be from the police, ask for their name, station, and case number—then call the station back to confirm.

- Never share sensitive details – Legitimate banks and police will never ask for passwords or PINs.

- Stay calm under pressure – Scammers thrive on urgency. Always double-check before acting.

If you suspect fraud, report it immediately to your bank. With these scams on the rise, vigilance is the best defense against financial crime.

{Source BusinessTech}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com