Business

How the US Presidential Election Could Impact South Africa’s Rand and Markets

How the US Presidential Election Could Impact South Africa’s Rand and Markets

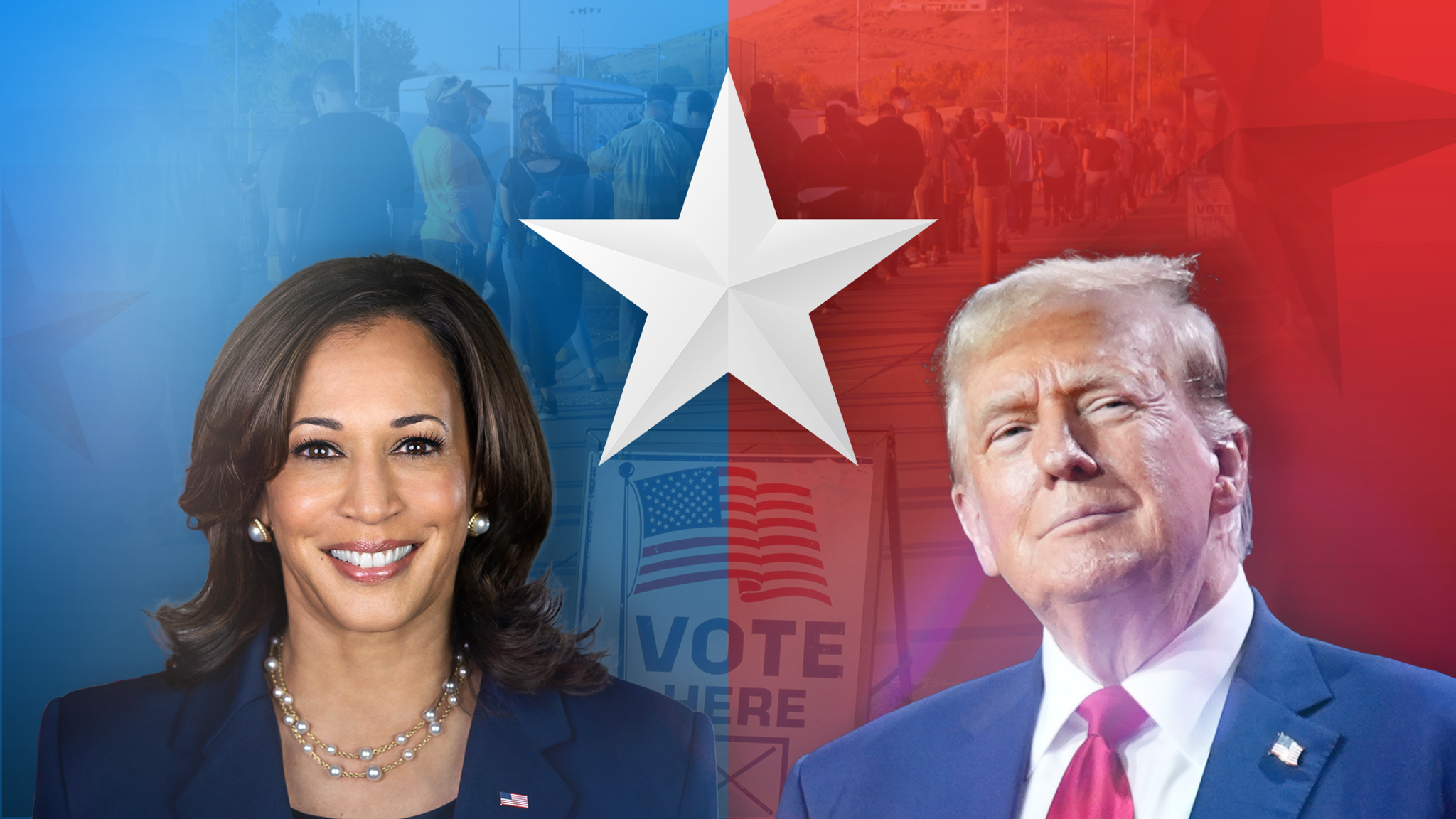

The upcoming US presidential election on November 5 will see former President Donald Trump and current Vice President Kamala Harris compete for the White House. While the US may seem distant from South Africa, the election outcome could significantly influence South Africa’s economy, affecting the rand, trade, and market confidence.

Immediate Rand Impact

Investec Chief Economist Annabel Bishop warns that a Trump victory could negatively impact the rand, given his emphasis on protectionist policies. Under Trump’s previous administration, the imposition of tariffs and sanctions led to increased uncertainty, which often pressured emerging markets like South Africa. The rand has already shown signs of volatility, weakening to R17.80/USD amid Trump’s polling gains.

Should Harris win, Bishop expects more policy continuity from the current Biden administration, with fewer disruptions to trade policies.

Economic Forecast and Market Reaction

The election’s impact on global risk sentiment is already being felt in South Africa. According to Bloomberg, Trump has proposed a baseline 20% tariff on all imports, increasing to 60% for Chinese products. Harris, in contrast, has suggested no major shifts from Biden’s policies, which could offer more stability for international markets.

The Bureau for Economic Research (BER) has highlighted the risks of policy gridlock if the new president faces a divided Congress. With a high chance that the Republicans may secure control of the Senate, the possibility of a “split government” could slow down major policy decisions, which may lead to market uncertainty.

South African Market Volatility

Beyond the US election, South African markets are also navigating shifts in global interest rates, where US Fed policies have indicated a slower rate-cutting cycle than anticipated. This has seen foreign investors pulling back from South African equities and bonds in October after net purchases in September. The yield on South Africa’s ten-year bond rose to over 10.50%, highlighting a cautious investor sentiment.

In addition, the recent medium-term budget presentation from South Africa’s finance ministry did little to bolster confidence in the local market, with investors viewing the budget as lacking in substantial reforms for economic stability.

Slow Rate-Cutting Cycles Expected

In line with US trends, South Africa’s interest rate cuts are expected to proceed gradually. The South African Reserve Bank is anticipated to approve a modest 25-basis point cut at its upcoming meeting in November, which may offer only limited relief to the rand.

As the US election draws near, South African markets will closely monitor the outcome, with both short-term and long-term impacts expected to play a role in shaping the country’s economic trajectory.