Published

3 weeks agoon

By

zaghrah

As South Africa’s digital payment systems evolve at lightning speed, so too do the security threats lurking beneath them. Standard Bank has issued a critical warning to customers about the increasing risks tied to Instant EFTs and PayShap, placing a spotlight on real-time payments as a growing target for cybercriminals.

A Shift Toward Speed – and Risk

Over the past few years, South Africa’s payment ecosystem has seen major innovation, with cloud computing, artificial intelligence, and real-time processing redefining how money moves. While these technologies offer greater convenience and efficiency, they also create more complex challenges in keeping customer data and transactions secure.

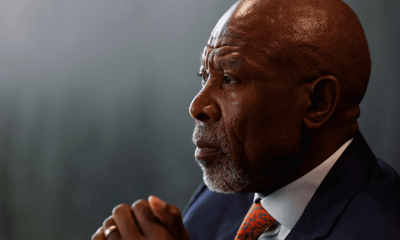

Ontiretse Modise, Head of Cash Management in Transaction Banking at Standard Bank CIB, says the shift to cloud-based and instant payment platforms has opened new vulnerabilities.

“As payment systems move toward real-time processing, the need for constant vigilance increases,” Modise said. “Traditional security methods are no longer enough.”

EFTs and PayShap: Final and Irrevocable

The South African Reserve Bank (SARB) has echoed these concerns, warning that EFT and PayShap payments are final and irrevocable. This means customers cannot reverse a transaction even in the case of fraud—leaving consumers particularly exposed if they fall victim.

Standard Bank emphasized that when payments are made using credit cards or overdraft facilities, customers may even be liable for the interest incurred, further compounding the financial impact.

A Shared Responsibility

While banks like Standard Bank are investing heavily in machine learning, real-time monitoring, and fraud detection tools, they stress that cybersecurity is a shared responsibility.

“Our work alone won’t eliminate fraud,” Modise said. “We’re actively working with our clients to help them boost their fraud awareness and internal controls.”

This collaborative approach aims to build a united front against cybercriminals, ensuring customers are educated and equipped to spot red flags early.

Not the First Fraud Alert

This isn’t the first time Standard Bank has raised alarm bells. Just this past week, the bank cautioned South Africans about a rise in Card-Not-Present (CNP) fraud, especially on platforms like food delivery apps, e-hailing services, and video-on-demand platforms.

CNP fraud occurs when stolen card details are used to make online purchases without needing the physical card. Often, consumers unknowingly hand over their sensitive data via malicious pop-up ads, cloned websites, or compromised platforms.

Adding to the list of scams, the bank also flagged a fake WhatsApp group that falsely claimed affiliation with Standard Bank and its subsidiaries, promoting fraudulent investment schemes.

Staying Safe in a Digital-First World

As digital transactions become the norm, cybercriminals are becoming more opportunistic. Standard Bank’s message is clear: being aware is your first line of defense.

Here are some practical tips for customers:

Double-check website URLs before entering payment information.

Avoid clicking on suspicious ads or pop-ups.

Never share sensitive banking details via WhatsApp or social media.

Enable real-time transaction notifications and two-factor authentication where possible.

Report any suspicious activity to your bank immediately.

The evolution of South Africa’s payment systems brings both opportunity and risk. Standard Bank’s latest EFT fraud warning serves as a vital reminder that cybersecurity starts with all of us—whether you’re sending money, shopping online, or running a business. Stay informed, stay alert, and stay secure.

{Source BusinessTech}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com

MTN Confirms Cybersecurity Breach: Customer Data Exposed in Select Markets

Lower Oil Prices Push South Africa’s Inflation to 4-Year Low, Says Kganyago

African Bank Gives 10% Ownership to Employees in Bold Move Towards Inclusivity

South African Inflation Drops to 2.7% in March, Raising Hopes for Interest Rate Cuts

South Africa’s AI Boom Faces a New Cybersecurity Challenge: Identity Management

South Africa’s Hidden R1 Trillion Powerhouse: The Township Economy on the Rise