Business

China’s Economic Momentum Faces Trade Turbulence, But Optimism Remains for 2025

Published

2 weeks agoon

By

zaghrah

Entering 2025, Chinese equities have shown positive momentum, buoyed by the gradual lifting of years of policy overhangs. After a challenging few years, China’s economy was beginning to stabilize, with factors such as renewed stimulus, a stabilizing property market, and a recovering tech sector leading to market optimism. This initial momentum, however, faced a serious test in March when the United States escalated its trade war with China, imposing sweeping new tariffs on Chinese imports, which Beijing swiftly countered.

While the tariff conflict stirred market uncertainty, investment firm Foord remains cautiously optimistic about China’s economic prospects for 2025. This optimism stems from a broader, pro-growth shift in Chinese policy that has been in motion since September 2024. The Chinese government has ramped up fiscal and monetary support for the world’s second-largest economy, including significant bond issuance, rate cuts, and infrastructure investment. These measures are aimed at mitigating persistent domestic weaknesses and offsetting the global demand uncertainty caused by the evolving trade war.

The Property Market Shows Signs of Stability

One of the key pillars of China’s economic recovery has been support for its beleaguered property sector. For years, the housing market has been a source of economic fragility. However, recent signs suggest stability, particularly in Tier-1 cities where transaction volumes have picked up, and property prices are showing positive movement. Smaller developers continue to face challenges, but government interventions, such as debt-swap programs and credit easing, are helping to stabilize the market. While it may take time for property investment to rebound fully, the risk of a disorderly housing market collapse appears to have diminished.

Technology Sector Rebound Amid Regulatory Shifts

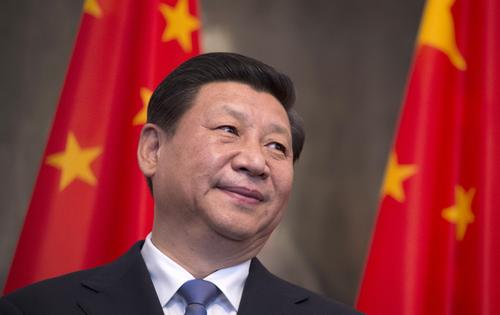

The tech sector, another critical engine of growth for China, has also benefited from recent regulatory changes. A February meeting between President Xi Jinping and major tech CEOs signaled a shift in government stance, acknowledging the importance of the sector for long-term economic competitiveness. With this newfound support, Chinese tech companies are beginning to flourish once again, despite ongoing restrictions on semiconductor imports. The Hang Seng Tech Index saw a surge in the first quarter of 2025, with investors regaining confidence in the sector’s earnings momentum. The launch of DeepSeek, an advanced AI model, has further demonstrated China’s innovative capabilities, positioning the nation for growth in high-tech industries.

Impact of the Trade War and China’s Response

Despite the positive economic indicators, the renewed tariff war with the United States has added volatility to the markets. By April 2025, the US had raised its effective tariffs on Chinese goods to nearly 145%, prompting China to retaliate with its own set of countermeasures. As a result, Chinese equities briefly entered correction territory, causing a sharp market sell-off. However, Beijing acted swiftly, with state funds intervening to stabilize the equity markets. Additionally, policymakers have signaled plans for further stimulus, including enhanced tax rebates for exporters, consumption incentives, and targeted liquidity support. While these developments have disrupted the positive narrative, the broader economic outlook for China remains intact.

A Shift in China’s Trade Strategy

Over the past decade, China’s reliance on the US for exports has decreased significantly, falling from over 7% of GDP to under 3%. This shift has been part of China’s broader strategy to diversify its trade partnerships, focusing on rising intra-Asian trade and deeper integration through regional agreements. As the domestic consumer base grows, China’s vulnerability to US-specific shocks has decreased. Additionally, long-term growth drivers such as AI, green energy, and advanced manufacturing continue to attract investment, which bodes well for the country’s future economic prospects.

Investment Opportunities in China

Despite the trade turbulence, Chinese equities remain among the cheapest in global markets, with valuations reflecting deep investor skepticism. However, corporate fundamentals are improving, and investors are beginning to recognize the opportunities in the region. Foord remains overweight on China, focusing on companies that align with long-term policy goals, have robust balance sheets, and are led by proven management teams. The firm sees potential in sectors such as technology, select consumer businesses, and dividend-paying state-owned enterprises.

Resilience Amid Volatility

The escalating tariff conflict with the US has introduced significant volatility into China’s economic landscape. Nevertheless, the country’s pro-growth policy stance, ongoing innovation, and attractive valuations suggest that the economic momentum is not over—only temporarily paused. While challenges persist, the long-term investment case for China remains strong. As the government continues to implement supportive measures and investors regain confidence, the outlook for Chinese equities in 2025 is cautiously optimistic.

Foord, along with other investors, continues to invest selectively in this market, confident that the resilience shown by Chinese businesses and the broader economy will prevail, even in the face of ongoing trade uncertainties.

{Source: IOL}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com

You may like

-

Mashatile Warns of Job Losses as Global Trade Barriers Threaten South Africa’s Economy

-

Foreign Investors Return to JSE as South African Stocks Outperform Global Markets

-

How US Tariffs on South Africa Are Forcing Small Businesses to Rethink Their Strategies

-

BMW Confident in Navigating US Tariffs, Banking on Global Footprint and Free Trade Push

-

Southern African Customs Union Faces Revenue Decline as Global Trade War Threatens Regional Economies

-

South African Grape Industry at Risk as US Tariffs Threaten Export Growth