Business

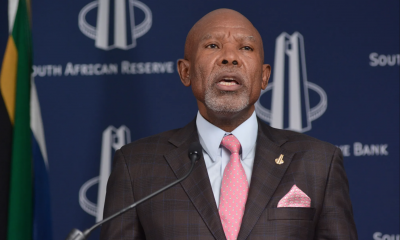

Lesetja Kganyago Warns of Global Economic Risks Amid Trump’s Trade Policies

The global economy is at risk of fragmentation due to US President Donald Trump’s aggressive trade policies, South African Reserve Bank (SARB) Governor Lesetja Kganyago cautioned ahead of the G-20 summit in Cape Town.

Speaking in an interview on Monday, Kganyago expressed concerns over growing uncertainty in financial markets as the US continues its tariff threats against major global economies, including China.

“We are seeing trade fragmentation, we are seeing economic fragmentation, and it just raises the level of uncertainty,” Kganyago stated.

How Trump’s Trade War Impacts South Africa

Trump’s policies have shaken international trade, with tariffs on steel, aluminum, and automobiles disrupting global supply chains. For smaller economies like South Africa, the repercussions could be severe.

The SARB recently lowered interest rates by 25 basis points to 7.5% but warned that escalating trade tensions could push inflation higher and force central banks, including the US Federal Reserve, to reconsider recent rate cuts.

“The only thing that a small open economy can do is to strengthen its resilience, build the buffers, because this thing would come as a shock,” Kganyago emphasized.

US Relations Strained as Top Officials Skip G-20 Meetings

Adding to the economic uncertainty, the US government has taken a hard stance on South Africa. Trump froze financial aid over false claims of land seizures, and key US officials, including Treasury Secretary Scott Bessent and Secretary of State Marco Rubio, have skipped critical G-20 meetings hosted in South Africa.

This diplomatic snub raises questions about the future of US-South Africa economic relations, especially as South Africa holds the G-20 presidency before the US takes over in 2026.

South Africa’s VAT Hike Debate and Monetary Policy Challenges

On the domestic front, Kganyago addressed the controversial proposal to raise South Africa’s value-added tax (VAT) by two percentage points. The backlash from political and business sectors led to a delay in the national budget announcement until March 12.

While the VAT hike would have created short-term financial shocks, Kganyago stressed that SARB’s response would depend on its impact on inflation expectations and broader economic stability.

“Monetary policy responds to those second-round effects, not to the shock,” he clarified.

What’s Next for South Africa’s Economy?

With ongoing global trade disputes and domestic fiscal challenges, South Africa faces a period of heightened economic uncertainty. The SARB’s next interest rate decision, set for March 20, will be closely watched as the country navigates these economic headwinds.

As global markets remain volatile, Kganyago’s warning serves as a reminder for South Africa to build resilience and prepare for possible economic shocks.

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com