Business

Interest Rate Forecast: South Africa Poised for Modest Cuts in 2025

Global central banks are navigating a cautious path in 2025, balancing economic recovery with inflation risks. The South African Reserve Bank (SARB) is no exception, with policymakers signaling modest interest rate cuts amid subdued inflation.

Global Monetary Policy Trends in 2025

- Slower Easing: Bloomberg Economics projects advanced economies to cut rates by just 72 basis points in 2025, compared to sharper declines in 2024.

- Trump Factor: The policies of incoming US President Donald Trump, including potential trade tariffs, add uncertainty for global central banks, stoking fears of inflationary shocks.

- Advanced Economies: While the eurozone and UK continue to ease rates, the US Federal Reserve is focusing on preventing inflation resurgence, slowing its pace of cuts.

South Africa’s Monetary Policy Outlook

South Africa’s inflation has remained below the mid-point of the SARB’s 3%-6% target range since August 2024. This has provided the central bank with room to ease borrowing costs to support economic growth.

- Recent Cuts: The SARB lowered rates by 50 basis points since September 2024, bringing the repo rate to 7.75%.

- Inflation Trends: Inflation is projected to average 4% in 2025, staying comfortably within the target range.

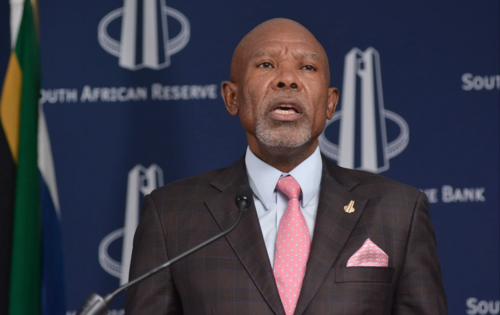

Governor Lesetja Kganyago’s Warning

Governor Kganyago highlighted potential risks stemming from Trump’s policy moves, which could disrupt global trade and increase inflationary pressures.

“The SARB will take a cautious, meeting-by-meeting approach, with no pre-commitments to a specific rate path,” Kganyago stated.

Bloomberg Forecast

Bloomberg Economics forecasts the SARB to cut rates by another 50 basis points in Q1 2025, stabilizing the repo rate at 7.25%.

- Key Predictions:

- Inflation may stay at the lower band of the SARB’s target in early 2025, rising to 4.5% by Q4 2025.

- The output gap is expected to narrow to zero by 2027, supporting a halt in further rate cuts.

Economic Implications for South Africa

The SARB’s cautious easing reflects its commitment to balancing economic recovery with inflation control. As global monetary policy tightens and local factors, like subdued inflation, persist, the central bank’s strategy will be critical in maintaining stability.

With a forecasted repo rate of 7.25% by the end of 2025, South African businesses and consumers could see some relief, albeit modest.

Follow Joburg ETC on Facebook, Twitter and Instagram

For more News in Johannesburg, visit joburgetc.com