Business

Pick n Pay’s Market Moves: Why Boxer’s IPO Could Save the Brand from ‘Negative Value

Pick n Pay’s Market Value Dilemma: Boxer IPO to the Rescue?

If you thought Pick n Pay was just another grocery chain, think again. The iconic South African retailer is facing a financial plot twist so steep it’s got investors talking: Pick n Pay’s stores alone are worth “less than zero.” That’s right. If you separate its profitable Boxer Superstores from the rest of its assets, Pick n Pay’s core business looks more like a liability than an asset. Here’s the lowdown on why Pick n Pay’s fortunes are now tied to Boxer’s upcoming IPO on the Johannesburg Stock Exchange (JSE).

Boxer IPO: The Saving Grace for Pick n Pay?

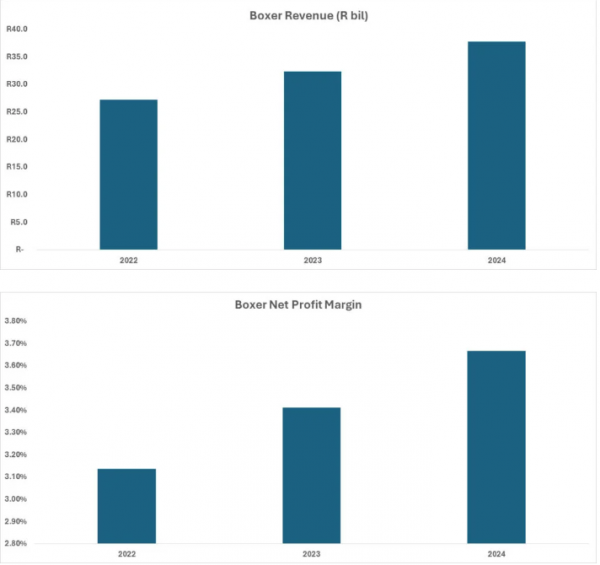

On November 28, 2024, Boxer Superstores, a wholly-owned Pick n Pay subsidiary, will debut on the main board of the JSE. Investors are buzzing, and here’s why: Boxer has been carrying Pick n Pay financially for years, performing well even as its parent company’s debt piled up. With a turnover of R37.4 billion and a trading profit of R2.1 billion in recent years, Boxer isn’t just a grocery chain; it’s the top discount grocery retailer in South Africa. In the last two years alone, Boxer’s turnover grew at an impressive 18.6%, with market share rocketing to 68% in the discount grocery segment.

Why the IPO, Though?

So, why the big rush to list Boxer separately? It’s all about survival. Earlier this year, Pick n Pay disclosed it was technically insolvent, with liabilities outweighing its assets. The company rolled out a two-phase plan to get back in the black. Step one involved a R4 billion rights offer to help stabilize its finances, leaving it with positive equity of R2.9 billion. But step two—the Boxer IPO—is the real game-changer. Through this offering, Pick n Pay aims to raise between R8 billion and R8.5 billion to tackle its debts and inject fresh energy into its core supermarket business.

The Shocking ‘Negative Value’ Factor

As Boxer moves toward its IPO, something wild is emerging: Pick n Pay’s actual market cap stands at R19 billion, but once Boxer’s assets are separated, Pick n Pay’s worth without Boxer slides into negative territory. In simpler terms, Boxer alone is worth more than Pick n Pay’s entire current market valuation. Pick n Pay’s price-to-sales ratio sits at -0.01, and its price-to-book ratio is at a jaw-dropping -3.6. So every rand in Pick n Pay store revenue literally brings down the group’s overall value. If Boxer’s IPO hits even its lowest valuation, Pick n Pay stores might drag the group’s value down by R3.5 billion.

Breaking Down Boxer’s Pre-IPO Strength

Boxer’s financials, now disclosed pre-IPO, show impressive profitability with a 3.7% net profit margin that even rivals Shoprite. Boxer’s ambitious growth plan includes adding 65 new stores by year-end and potentially doubling its store count over the next six to seven years. These numbers highlight why Boxer is so valuable in the Pick n Pay ecosystem and why its independent listing is so enticing to investors.

A New Start for Pick n Pay?

With the IPO, Pick n Pay hopes to finally ease its debt burden and pump resources back into its supermarkets, which desperately need a financial facelift. The Boxer IPO also brings transparency to investors, showing exactly how Pick n Pay plans to allocate funds and focus on its core business. However, separating from Boxer also exposes the struggles Pick n Pay faces in a highly competitive retail market.

Final Thoughts: Will Pick n Pay Bounce Back?

With Boxer’s IPO on the horizon, the retail world will be watching to see if this lifeline can stabilize Pick n Pay’s future. The listing is about more than just raising funds; it’s a shot at a fresh start for Pick n Pay’s supermarket business. Boxer’s success and Pick n Pay’s debt overhaul could transform the group’s fortunes—or reveal just how deep the challenges run.

With a rocky road ahead, one thing is clear: Pick n Pay’s days of coasting on Boxer’s success are over. The company is banking on Boxer’s IPO to give it the reboot it desperately needs.