Alberton Record

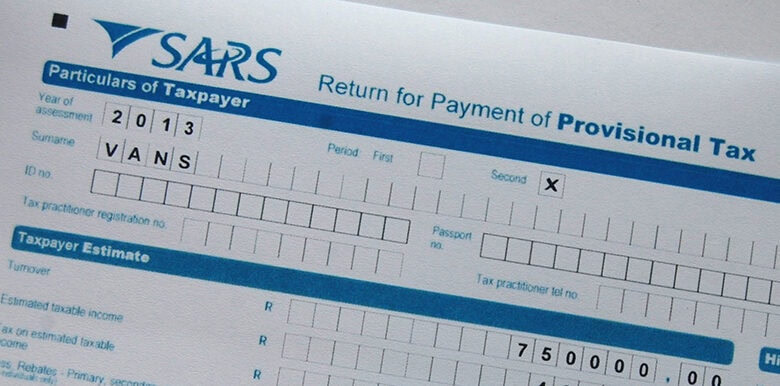

Final Reminder: File your taxes by October 21

Efficient Ways to Manage Your Taxes in Joburg

For many busy residents in Joburg, handling tax matters swiftly and conveniently is essential. Here are some tips to streamline the process:

Utilize SARS eFiling or SARS MobiApp

- Accessible anytime, anywhere

- Available 24/7 for your convenience

Post-Submission Procedures

Upon submission, a Notice of Assessment (ITA34) document will be issued. This comprehensive summary outlines your income, expenses, and deductions, along with your tax liability calculation.

Understanding Your ITA34:

- A negative sign indicates a refund due

- Refunds are processed within 72 hours if criteria are met:

- Updated banking details

- No outstanding returns or debt

- Not selected for audit

If taxes are owed to SARS, payment deadlines apply based on assessment status:

- Not automatically assessed: due within 30 days

- Automatically assessed: due 30 days after the 2024 filing season

Failure to comply with payment deadlines may result in penalties, including recurring monthly administrative fees based on taxable income.

Employer Reconciliation Filing

The current Employer Interim Reconciliation period closes on 31 October 2024 for the 2025 Employer Filing Season.

Submission Channels:

- Employers with up to 50 certificates: SARS eFiling or SARS e@syFile™

- Employers with more than 50 certificates: e@syFile™ Employer

Ensure accurate reconciliation submission by the deadline to avoid penalties and interest.

Alert: Impersonation Scam

Be cautious of fraudulent emails posing as SARS officials, requesting payments for outstanding balances. Verify sender details and report suspicious activities immediately.

Source: The Citizen