News

South African Reserve Bank Shocks Nation with Second Repo Rate Hike – What It Means for Your Finances

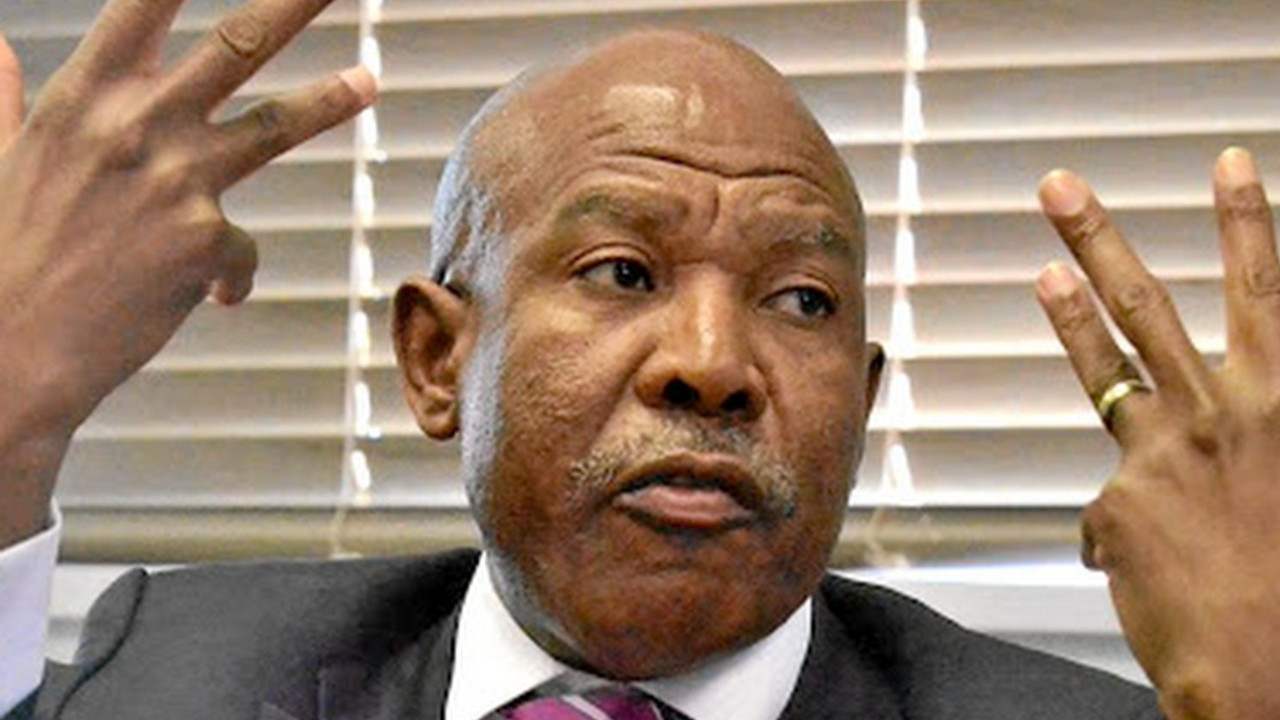

South African consumer finances have been dealt another blow with the South African Reserve Bank’s Monetary Policy Committee Meeting (MPC) announcing a 50 basis points (BPS) increase in the repurchase rate. SARB governor Lesetja Kganyago announced the hike, taking the repo rate from 7.25% to 7.70% and increasing the prime lending rate from 10.75% to 11.25%.

As reported by IOL, this decision was a surprise as analysts and economists had widely predicted a 25 basis points increase. The central bank has been aggressively raising the rate to help curb inflation. The previous eight committee meetings resulted in rate increases. This latest increase marks the ninth consecutive rate hike, totalling 425 bps since November 2021, as the Reserve Bank attempts to tame inflation.

However, inflation still exceeds the bank’s target range due to the rolling power cuts imposed on the country by the ailing state-owned power utility, Eskom. As a result, the five-member MPC was split 3-2 in its decision, with three members preferring a 50 bps increase and two wanting a 25 bps rate increase.

Against this backdrop, the MPC decided to increase the repurchase rate by 50 basis points to 7.75% per year, with effect from the 31stof March 2023. Three members of the Committee preferred the announced increase. Two members preferred a 25 basis points increase. #MPCMARC2023 pic.twitter.com/LMAKRvH77a

— SA Reserve Bank (@SAReserveBank) March 30, 2023

Also read: Massive Losses Revealed in Court Hearing: Shocking Impact of Load Shedding on South Africa’s Economy

February’s consumer inflation in South Africa rose to 7.0% year on year from 6.9% in January, which could indicate that rolling power cuts nationwide are fuelling price increases. The central bank aims at inflation between 3% and 6%. Kganyago said on Thursday that “sticky inflation, sluggish growth, and now elevated financial stability risks mark the global economy” and that “with inflation and policy rates remaining higher for longer, and new weaknesses emerging in financial institutions, we expect global financial markets to remain volatile.”

The effect on consumers is that the cost of servicing their debt will increase, striking cash-strapped consumers. Hayley Parry, the facilitator at 1Life’s Truth About Money and money coach, advised consumers to take a “financial health” day to get their finances in order. This strategy means ensuring an emergency fund is in place, paying off as much debt as possible, and taking proactive steps to manage cash flow as inflation increases prices.

Before the governor’s announcement, Frank Blackmore, Lead Economist at KPMG, had predicted consumers’ wallets should prepare for another hit. Blackmore and many other analysts had expected a 25 bps increase. However, the bank’s decision to increase the repo rate by 50 bps instead has sent shock waves through the country. With costs rising due to inflation, higher food prices, and fluctuating fuel prices, many consumers with loans to repay are already finding it financially challenging.

Also read:

Picture: Twitter / TheLegalSA